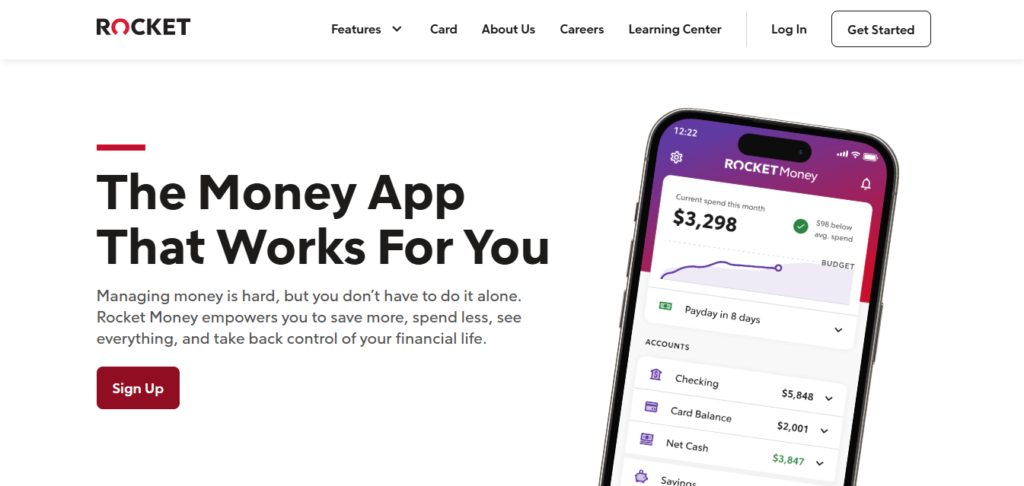

Rocket Money is a legit personal finance app that helps users manage their money effectively with features like subscription tracking, budgeting tools, and bill negotiation. It connects to bank accounts and financial institutions to provide a clear overview of your finances, making it easier to save and reduce unnecessary spending.

This article will cover how Rocket Money works, its key features, pricing plans, and user feedback to help you decide if it’s worth using for managing your finances.

What is Rocket Money?

Rocket Money is an all-in-one, personal finance app that simplifies the way you manage your financial life. With features like tracking your spending and managing subscriptions, it offers users the ability to save money by uncovering unnecessary subscriptions that may be draining their bank accounts.

The app also includes budgeting tools that help users stay on top of their expenses and automating savings to ensure you’re always putting aside money for future goals. Rocket Money connects with bank accounts, credit cards, and various financial institutions to provide a comprehensive view of your finances, making it easier than ever to take control of your budget and negotiate bills with ease.

Whether you’re looking to improve your financial habits or simply manage your money more effectively, Rocket Money serves as a versatile tool to help you achieve financial success.

Key Features of Rocket Money

Subscription Tracking

Rocket Money’s subscription tracking feature empowers users to efficiently track their recurring subscriptions by scanning bank statements to identify all active payments. This tool makes it easy for users to manage their subscriptions, ensuring they don’t overlook any unwanted services.

With the ability to cancel unnecessary subscriptions, users can save money by eliminating subscriptions that may be draining their accounts.

Rocket Money’s subscription tracking feature allows you to list and identify services that cost a significant amount, enabling you to make smarter financial decisions and reduce wasteful spending.

Budgeting Tools

Rocket Money offers personalized budget tools that help users manage their income and understand their spending patterns. By allowing you to categorize your expenses into specific buckets such as groceries, entertainment, and bills, the app provides detailed insights into where your money is going.

This makes it easier to cut back on unnecessary spending and save money. With Rocket Money, you can gain a clearer picture of your financial habits and take control of your budgeting, ensuring you stay within your means and work toward your financial goals.

Bill Negotiation

Rocket Money’s bill negotiation feature connects users with a team of experts who assist in negotiating better rates with service providers for monthly bills such as cable, internet, and phone services.

The app allows you to negotiate directly with providers to lower payments and secure better rates, helping users save on their recurring expenses.

With the support of Rocket Money’s professional team, you can easily navigate the process of negotiating your bills to ensure you’re paying a fair price without overpaying.

Automated Savings

Rocket Money makes it easy to save money with its automated savings feature that works effortlessly to help users grow their savings. By enabling a round-up feature, the app automatically rounds up your purchases to the nearest dollar and deposits the difference into your savings account.

This set-it-and-forget-it approach ensures that you can save without actively thinking about it, making it a simple and effective way to build savings over time. Whether you’re looking to start saving or increase your savings, Rocket Money’s automation helps you save money without requiring constant attention.

Credit Score Monitoring

Rocket Money helps users monitor their credit score, providing a clear view of their credit standing and the key factors that impact it. With real-time updates and actionable insights, the app empowers users to take steps to improve their score by identifying areas for improvement.

Whether you’re looking to raise your credit score or simply stay informed about your financial health, Rocket Money offers the tools to help users make better decisions and track their progress over time.

Financial Insights

Rocket Money provides users with a comprehensive dashboard that offers a snapshot of their overall financial health through detailed visualizations. The app tracks spending trends, comparing income and expenses to give users a clear picture of their net savings.

With insights into financial habits, users can set and track goals, helping them make more informed decisions about their spending and saving patterns. This feature empowers users to take control of their finances, adjust their budgeting strategies, and ultimately work toward achieving their financial objectives.

Easy User Interface

Rocket Money features a clean, intuitive design that allows both novice and experienced users to easily navigate through the app. The layout is straightforward, making it simple for users to manage their budget and review their subscription list without feeling overwhelmed.

Whether you’re tracking your spending or setting savings goals, the app’s easy to use interface ensures that financial management is seamless and accessible to everyone.

How Does Rocket Money Work?

Rocket Money links your bank account and credit cards to the app, allowing it to track your income and expenses automatically. Once linked, the app analyzes your transactions, categorizes them, and presents the data in a digestible format, offering valuable insights into your spending habits.

It then suggests ways to save money, including recommending the cancellation of unnecessary subscriptions and lowering your monthly utility bills. For those who want more control, the app allows you to manually add any financial data.

Additionally, Rocket Money’s bill negotiation feature connects users to experts who handle the negotiation process for recurring bills, helping you save dollars on your monthly expenses.

Pricing and Subscription Plans

Rocket Money offers several subscription plans, including a free version and premium options. Here’s a breakdown of the pricing:

Free Version

The free version of Rocket Money offers users access to essential basic features, including subscription tracking, budgeting, and bill reminders. This plan serves as a great starting point for those looking to manage their finances in an organized order.

However, it lacks the premium features such as bill negotiation and advanced savings tools, which are available in the higher-tier subscriptions. This allows users to try out the core functionalities before deciding if they need the additional services for more comprehensive financial management.

Premium Plans

Rocket Money’s premium plans offer additional features, including bill negotiation, smart savings automation, and enhanced financial insights.

There are two pricing tiers for the premium plan:

Premium Plan:

The Premium plan of Rocket Money, priced at $3.99/month, unlocks a range of features designed to provide more in-depth financial assistance. This includes bill negotiation, advanced budgeting, and sophisticated savings tools.

With this option, users can benefit from more hands-on management of their finances, gaining access to tools that help them optimize savings and reduce monthly expenses through expert negotiation.

It’s an ideal choice for individuals looking to take a more proactive approach to managing their financial goals.

Premium Plus Plan:

The Premium Plus plan, priced at $12.99/month, offers all the features of the Premium plan while adding additional tools to help users manage debt and optimize their credit score. This plan is ideal for those looking for a more comprehensive financial management experience, with personalized support tailored to individual needs. =

Whether you’re focusing on improving your credit score or handling complex financial challenges, this plan provides the necessary resources to stay on top of your financial goals.

Rocket Money’s Cost Savings

Rocket Money is designed to pay for itself with its bill negotiation feature, which can save users up to $600 per year through effective bill negotiations. This tool helps save money on recurring bills, making it a cost-effective solution even before considering the premium plans.

The potential savings generated from bill negotiations often offset the cost of subscribing, allowing users to focus on financial growth without worrying about monthly expenses.

User Ratings and Feedback

Rocket Money has garnered positive feedback from users across various platforms, reflecting its utility and user-friendly features. The app has consistently received high ratings, showcasing its ability to meet the financial management needs of its users.

Trustpilot:

On Trustpilot, Rocket Money has earned a 4.2/5 rating from 4,076 reviews, with many users praising its convenience and the helpful features it offers. The overall feedback from users is favorable, with several noting that it continues to improve their financial management.

Rocket Money is well-received for its ease of use and its ability to simplify budgeting, showing that users appreciate the practicality and effectiveness of the app in managing their finances.

Apple App Store:

On the Apple App Store, Rocket Money has earned a 4.4/5 rating from a large user base, receiving over 153.9K reviews. This high rating reflects user satisfaction, especially among iPhone users who have praised its expense tracking and budgeting tools.

These features have clearly resonated with the app’s demographic, demonstrating how effectively it addresses the needs of users looking to manage their finances through a simple and efficient interface.

Trust Index:

On the Trust Index, Rocket Money maintains a strong 4.4/5 rating with 151,774 reviews, showcasing its positive reputation among users. The app’s consistency in delivering reliable and effective tools for managing personal finances has contributed significantly to its high ratings. Users continue to highlight its reliability and effectiveness in helping them stay on top of their financial goals.

These ratings reflect the app’s ability to offer value to users by helping them manage their money effectively. However, it’s important to note that, like any service, there are occasional criticisms, particularly regarding its premium features and pricing. Nonetheless, the general consensus points toward a user-friendly and efficient tool for managing finances.

Pros and Cons of Rocket Money

Pros

Automatic Subscription Management

One of the most praised features of Rocket Money is its ability to automatically detect and manage subscriptions. The app simplifies the process by identifying recurring payments linked to your bank accounts, making it easier to spot unwanted services and recurring charges.

Users can effortlessly cancel unnecessary subscriptions, which helps eliminate unnecessary charges that can easily be overlooked or forgotten. This feature provides valuable insight into tracking payments, allowing users to save money and gain peace of mind knowing they’re not paying for unused or unwanted services.

Bill Negotiation

One of Rocket Money’s standout unique features is its bill negotiation service, which can help users secure lower bills on recurring services such as cable, internet, and phone services. The app connects users with a team of experts who work directly with service providers to negotiate better rates, taking the stress out of the negotiation process.

This means users can save hundreds of dollars annually on their bills, resulting in significantly lower expenses. The assistance provided by customer service representatives ensures that users benefit from saving more money without the hassle of doing it themselves.

Budgeting Tools

Rocket Money offers a suite of budgeting tools designed to help users manage budgets effectively by automatically categorizing spending across various categories such as groceries, dining, and entertainment. With these tools, users can set spending limits, track their financial goals, and gain valuable insights into their financial habits.

This feature helps in avoiding overspending while encouraging saving for future needs, whether it’s a big purchase or a much-awaited vacation. By creating a clear structure and promoting accountability, Rocket Money empowers users to stay on track toward their financial success.

Automated Savings

The automated savings feature of Rocket Money allows users to effortlessly save money by rounding up their purchases to the nearest dollar, contributing the spare change into a designated savings account.

This system encourages users to make small contributions without even thinking about it, helping them build a financial cushion over time. It fosters discipline in saving, while offering customizable savings goals to suit specific financial needs, such as building an emergency fund or saving for a vacation.

The simplicity and automation of this tool ensure that users stay on track with their financial goals with minimal effort.

Comprehensive Financial Insights

Rocket Money provides comprehensive financial insights by tracking income, expenses, and breaking down spending categories, which allows users to adjust habits and save money more effectively. With its clear visualizations, even financial novices can understand their financial health and make informed decisions.

The platform offers actionable tips and advice based on spending patterns, helping users make smarter financial decisions. As a powerful tool for improving financial literacy, Rocket Money empowers users to manage their finances more efficiently and maintain better control over their spending.

Cons

Premium Cost

While Rocket Money offers a free version with basic functionality, the premium plans, such as the Premium Plus plan, come with a steep monthly fee of $12.99 per month, which may be challenging for users on tight budgets.

The premium cost covers a full suite of features like bill negotiation, savings tools, and financial insights, but some users may find the price expensive for the additional features compared to the value they provide.

For those looking for a more affordable option, the paid version may not justify the premium cost, especially when the free version already offers basic functionality for managing finances.

Limited Features in Free Plan

The free version of Rocket Money offers basic functionality, which is sufficient for basic tasks like managing basic budgets and tracking subscriptions, but it lacks the advanced features available in the premium plans.

Users who want to access tools like bill negotiation, personalized savings plans, and financial insights must contend with a paywall, which can be frustrating for those seeking in-depth financial management without upgrading.

While the premium versions provide more comprehensive tools, the limitations of the free version may leave some users wanting more.

Occasional Bugs and Glitches

Although bugs and glitches are relatively rare, they can occur in Rocket Money, leading to inaccuracies in financial data. Users may experience incorrect categorization of transactions or issues with syncing their bank accounts, which can be frustrating when seeking precise financial management.

These irritating errors may result in incorrect spending reports, creating confusion and potentially undermining the app’s effectiveness. While the support team works to address these issues through updates and bug fixes, the occasional disruption can still detract from the overall user experience.

Limited Customization

One downside of Rocket Money is its limited customization options, especially with its budgeting tools. While the tools are functional, the app’s approach is somewhat rigid, offering only a granular approach to budgeting. Users may find the default categories limiting when trying to align their financial plans with unique needs.

The savings goals feature is helpful, but lacks full customizability, leaving users with less control over automatic savings and contributions. This limiting structure can make it harder for those with specific financial preferences to get the most out of the platform.

Privacy Concerns with Data Sharing

When using Rocket Money, users may feel hesitant about linking their bank accounts due to concerns about the privacy and security of their financial data.

While the app employs encryption to protect sensitive information, some individuals, especially those who are privacy-conscious, might worry about sharing their personal information with a third-party app.

Even though the app has received positive reviews regarding its data security, there are still inherent risks in providing access to financial data, which could lead to potential vulnerabilities in privacy.

Is Rocket Money Worth It?

For those looking to manage finances efficiently, Rocket Money offers a valuable tool to help track subscriptions, automate savings, and negotiate bills. It has gained popularity as one of the top finance management apps, with a free version offering essential features and premium plans that unlock additional features like advanced budgeting optimization and tools to help save money.

The ability to reduce bills and even improve credit score makes it worth considering for individuals aiming to streamline their financial habits.

With positive user ratings, Rocket Money has proven to be a reliable choice for many looking for financial assistance in a fast-paced world, though some may find that the premium plans provide the most significant benefits.

Conclusion: is it Legitimate?

In conclusion, Rocket Money offers a comprehensive set of tools that can help individuals take control of their finances by simplifying tasks like subscription management, budgeting, and bill negotiation. With both free and premium options, it caters to a wide range of users, although the premium cost may not suit everyone.

While occasional glitches and privacy concerns exist, the app’s overall value in streamlining financial management makes it a strong contender for those looking to save money and improve their financial habits.

Ultimately, whether Rocket Money is the right choice depends on your specific financial needs and willingness to invest in premium features for a more hands-on approach.

Check Similar Platform Review: Userfeel is Real or Fake?

Frequently asked Questions

What is Rocket Money and how does it work?

Rocket Money is a personal finance app that tracks your spending, manages subscriptions, and helps you save money. By linking your bank accounts, it categorizes transactions and offers financial insights, subscription management, and bill negotiation.

Is Rocket Money safe to use?

Yes, Rocket Money uses encryption to protect your data, ensuring the security of your financial information with trusted standards.

What features does Rocket Money offer?

It offers subscription tracking, budgeting, bill negotiation, automated savings, and financial insights, helping you stay on top of your money.

Can Rocket Money help me cancel subscriptions?

Yes, Rocket Money allows you to easily track and cancel unwanted subscriptions, helping you save on recurring charges.

How does Rocket Money save me money?

It identifies unnecessary subscriptions, helps negotiate lower bills, and automates savings, all of which contribute to saving money.

What are the subscription plans for Rocket Money?

Rocket Money has free and premium plans. The premium plan includes extra features like bill negotiation and smart savings, starting at $3.99 per month.

Can I use Rocket Money without paying for the premium version?

Yes, the free version provides basic features like subscription tracking and budgeting, but advanced features require a premium plan.

How does Rocket Money’s bill negotiation feature work?

Rocket Money negotiates with service providers on your behalf to lower your monthly bills, included in the premium plan.

Is Rocket Money good for budgeting?

Yes, it helps you create and track budgets by categorizing spending, making it easy to manage your finances and stay on track.

Does Rocket Money help with credit score monitoring?

Yes, the premium plan includes credit score monitoring and provides insights into factors affecting your score.