Chill is a legitimate insurance broker, regulated by the Central Bank of Ireland and partnered with established providers. However, numerous customer complaints and questionable practices, such as aggressive auto-renewals and unreliable service, raise significant doubts about its reliability.

In this article, we’ll dive into Chill’s company history, customer reviews, business practices, and alternatives to help you decide if it’s worth your trust.

Understanding Chill: Company Overview

A Brief History

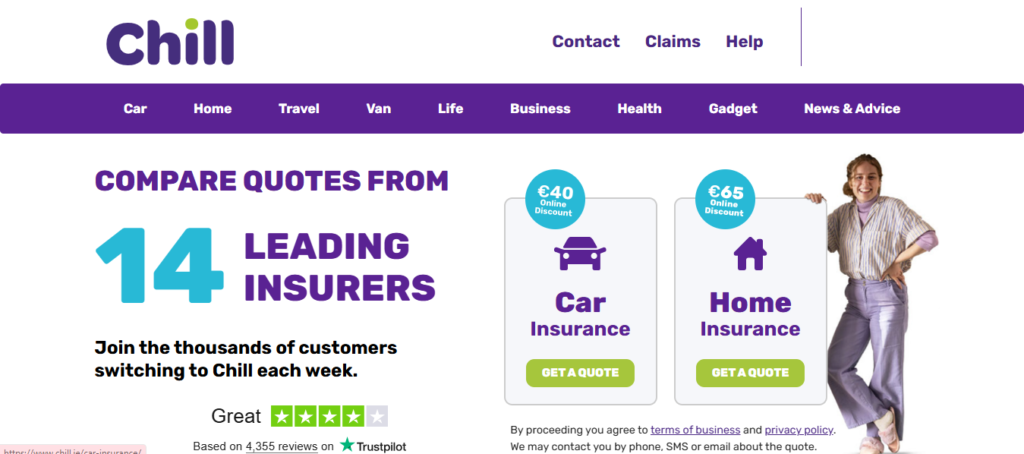

Chill, established in 2007, has carved a niche in simplifying insurance shopping for consumers. Acting as a broker, it specializes in comparing quotes from 14 insurance providers, offering competitive pricing across a wide range of insurance products.

These include car, home, life, health, travel, van, business, and even gadget insurance, ensuring customers find suitable options tailored to their needs.

Key Claims on the Website

The official website emphasizes its commitment to simplifying comparison and delivering the best prices on the market. Being regulated by the Central Bank of Ireland and adhering to the standards set by Brokers Ireland, it seeks to build trust with users.

While its claims of fostering transparency and positive user experiences resonate with many, some reviews appear to contradict these promises, sparking questions about their consistency.

Public Perception: Ratings Across Platforms

Mixed Ratings

The public perception of Chill varies widely across platforms, highlighting inconsistencies in user experiences:

- TrustPilot: 4.2/5 based on 4,355 reviews.

- Reviews.io: 2.8/5 based on 10 reviews.

- Yelp: 1.3/5 based on 33 reviews.

Disparity Between Platforms

While the high ratings on TrustPilot may seem reassuring, they are likely inflated by fake or paid reviews, a suspicion corroborated by numerous Reddit and YouTube users. Conversely, the poor ratings on Reviews.io and Yelp provide a more accurate reflection of customer dissatisfaction.

Red Flags in Ratings

- The high volume of negative feedback on platforms other than TrustPilot raises concerns about the authenticity of the positive reviews.

- Many users accuse Chill of prioritizing profits over customer satisfaction, leading to systemic issues in service delivery.

Customer Complaints: A Pattern of Unreliability

Delayed or Missing Documents

Many customers report delayed or missing documents, with complaints about the delay in providing valid proof of insurance.

These issues often lead to multiple follow-ups for resolution, leaving some customers uninsured for weeks while waiting for Chill’s customer service to resend essential documents for their renewed policy.

Unresponsive Customer Support

Unresponsive customer support has been heavily criticized due to long wait times exceeding 20+ minutes and rude, unhelpful agents.

Customers frequently describe failure to resolve basic queries, with agents being dismissive, hanging up on calls, or ignoring emails, leaving many issues with only partial resolution.

Unexplained Charges

Some users have faced unexpected fees and unexplained charges, such as high cancellation fees during the cooling-off period or automatic renewals processed without explicit requests.

Complaints include fees as high as €400 for canceling a policy within two days, with explanations deemed vague and unconvincing.

Issues with Claims

There are significant issues with the claims process, including unnecessary delays, denials, and months of unresolved cases.

Customers report how this affects their renewal premiums; one example involves a car breaking down and the underwriter being contacted directly due to a lack of assistance, turning an already stressful situation worse.

Technical Failures

Frequent technical failures in Chill’s online portal make it unreliable, complicating policy management and uploads.

Customers often face repeated errors when trying to upload documents, with many reporting that even emails go missing due to system glitches.

Social Media Exposure: What Are Users Saying?

Reddit and YouTube

Platforms like Reddit and YouTube are rife with users sharing negative experiences about Chill, citing concerns over scam-like practices. Allegations range from misleading quotes to the discovery of hidden fees, leaving many frustrated.

Some users argue that Chill, acting as a middleman, does little to add value to the insurance process, further fueling their dissatisfaction and distrust.

Social Media Trends

Recurring social media trends reveal common themes of discontent, including frequent auto-renewals where customers were charged for renewals they had explicitly declined.

This is compounded by miscommunication, such as receiving incorrect information about policies or premiums.

Combined with a perceived lack of transparency, these issues have led to a surge of online complaints, reinforcing doubts about the company’s reliability.

Analyzing Chill’s Business Practices

Paid Reviews on TrustPilot

Concerns about paid reviews on TrustPilot are mounting, with claims that Chill uses unusually high ratings to create a misleading image of reliability.

These alleged review manipulation practices, while not uncommon in competitive industries, are widely viewed as illegal and unethical, casting doubt on the company’s credibility and significantly undermining trust among potential customers.

Aggressive Auto-Renewal Policies

Chill’s aggressive auto-renewal policies have sparked widespread criticism, with many labeling them as predatory. Reports indicate that customers are renewed into expensive policies without their prior consent, often without clear communication.

This has left customers feeling trapped in unwanted contracts, leading to frustration and financial strain.

Lack of Accountability

A glaring lack of accountability has been observed in Chill’s handling of customer issues, as the company often redirects claims and disputes to underwriters rather than addressing them directly.

This leaves customers to navigate complex problems on their own, such as delayed claims resolutions or disputes, highlighting a lack of adequate support in critical situations.

Should You Trust Chill?

The Case for Legitimacy

Chill is recognized as a legitimate business, being regulated by the Central Bank of Ireland, which ensures compliance with industry standards.

The company works with reputable insurance providers such as AIG, Allianz, Aviva, AXA, Liberty Insurance, and Zurich, offering a range of policy options.

These established partnerships and regulatory oversight reinforce Chill’s position as a credible player in the insurance market, aiming to simplify insurance shopping for customers.

The Case Against Reliability

Despite its legitimacy, Chill faces criticism for poor service and questionable practices that undermine trust. Reports of unreliable service include delayed responses, unresolved issues, and the company’s inability to handle customer concerns effectively.

These experiences have led many to view Chill as unreliable, with the negatives often outweighing the benefits of their partnerships with reputed insurance providers.

Alternatives to Chill

For those seeking alternatives to Chill:

- AA Ireland stands out with its excellent customer service and commitment to transparent pricing, ensuring a smoother insurance experience.

- Aviva offers a seamless online experience backed by reliable support, making it a trusted choice for convenience-oriented customers.

- FBD Insurance has built a reputation as a trusted provider, with consistently strong customer satisfaction ratings, providing peace of mind for policyholders.

These alternatives may provide better service and reliability for those concerned about Chill’s practices.

Final Verdict: Is Chill Worth It?

While Chill may appear attractive due to competitive pricing and ease of use, their poor customer service, questionable review practices, and systemic inefficiencies make them an unreliable choice. Customers frequently report:

- Stressful experiences with claims and renewals.

- Hidden fees and unclear policies.

- Long wait times and unhelpful support agents.

Key Takeaway

If you value reliability and peace of mind, it’s best to avoid Chill and explore more trustworthy alternatives. Insurance is a critical financial safeguard, and the broker you choose should prioritize your needs—something Chill consistently fails to do.

Conclusion:

While Chill operates as a legitimate insurance broker, the company’s questionable practices and poor service make it an unreliable choice.

With so many better alternatives available, it’s wise to prioritize transparency, accountability, and customer satisfaction when choosing an insurance broker.

Check Similar Platform Review: Is BWJ Travel Legit?

Frequently asked Questions

What is Chill, and what services does it offer?

Chill is an insurance broker that helps customers compare quotes from multiple providers for car, home, life, health, travel, and other types of insurance. It aims to simplify the insurance shopping process by offering competitive pricing and tailored policy options.

Is Chill a legitimate company?

Yes, Chill is a legitimate insurance broker regulated by the Central Bank of Ireland. It partners with reputable insurers such as AXA, Allianz, and Aviva to provide a wide range of insurance options.

Why does Chill receive mixed customer reviews?

While some customers praise Chill for its competitive pricing and ease of use, others criticize its poor customer service, delayed responses, and unexpected charges. These inconsistencies contribute to its mixed reputation.

Are Chill’s online reviews trustworthy?

There are concerns about the authenticity of Chill’s online reviews, particularly on platforms like TrustPilot, where unusually high ratings may be influenced by paid reviews. Other platforms, such as Yelp, show more negative feedback.

Does Chill charge hidden fees?

Some customers have reported encountering unexpected charges, such as high cancellation fees or automatic renewals processed without consent. These issues highlight the need to carefully review their terms and conditions.

How does Chill handle customer support?

Chill’s customer support has received significant criticism for long wait times, unresponsive agents, and unresolved issues. Many customers report dissatisfaction with how their concerns are addressed.

Are Chill’s auto-renewal policies fair?

Chill has been criticized for aggressive auto-renewal practices, with customers being renewed into policies without clear communication or prior consent, leading to financial strain and frustration.

What are common issues with Chill’s claims process?

Customers frequently report delays, denials, and poor communication during the claims process. These issues often result in prolonged stress and unresolved cases.

Does Chill offer value for money?

Although Chill provides competitive pricing, its questionable practices and inconsistent service may outweigh the benefits. Many customers find better value with alternative brokers or direct insurers.

What are the best alternatives to Chill?

Reliable alternatives to Chill include AA Ireland, Aviva Direct, and FBD Insurance, which are praised for their transparency, reliable customer service, and straightforward claims processes.